Churn rate is a measure of the number of individuals or items that leave a collective group over a certain period of time. In business, this is about the number of customers who leave your organisation. This makes it one of the most important factors for organisations to measure their success. After all, customers in large numbers don't just leave unless you do something wrong. Thanks to customer feedback, you can detect and resolve dissatisfaction. In this article, we explain all about churn and the crucial role of customer feedback in it.

What is churn and how do you calculate it?

The term churn refers to losing customers or subscribers. This is measured by the metric churn rate. This metric shows the rate at which customers stop buying your service or stop doing business with your organisation. You calculate the metric as follows:

Churn rate = Amount of lost customers in certain period / amount of customers at the beginning of this period x 100

So suppose you have 150 customers at the beginning of the month. At the end of the month, you lose 17. Then your churn rate is 17/150 x 100 = 11.3%.

Of course, you often acquire new customers in a month. To give a more realistic picture, you can include this in your formula. This goes as follows:

Churn rate = Amount of lost customers in certain period / (amount of customers at the beginning of this period + amount of new customers in this certain period) x 100

So using the same math: 150 customers at the beginning of the month and you lose 17, but you gain 25. Then your churn rate becomes as follows: 17/(150 + 25) x 100% = 9.7%

What is an average churn rate?

actually, of course, you don't want to lose customers at all. But this is not entirely realistic. Every business will lose and gain customers. But what then is an average churn rate? When do you know if you are doing well? Profitwell looked at several studies and found that a churn rate is often between 1% and 17%. In doing so, they indicated that the most common churn rates are between 5% and 10%. Although this is a fine guideline, it does not say all. An average churn rate depends enormously on the type of industry, how easy it is to cancel for customers and how many competitors are also ready to fulfil the needs of your (former) customers.

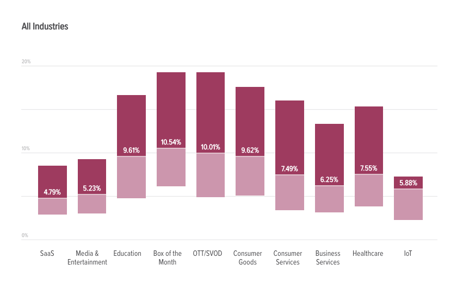

In the chart below, you can find the average churn rate by industry (Recurly, 2018 ). Here you can see that the average churn rates by industry are very different.

Bron: Average churn rate by industry door Recurly – 2018

Bron: Average churn rate by industry door Recurly – 2018

Work on customer loyalty to avoid churn

Retaining a customer is a lot easier than convincing a potential customer. Yet organisations' efforts rarely focus on building loyalty. A shame! Because by doing so, you actually strengthen the success of the entire organisation. So how exactly can you combat churn as an organisation?

1. By making your customers an integral part of your marketing actions. Think of sending newsletters or invitations to events and webinars. In this way, you keep your customers involved and up to date with new, relevant information.

2. By rewarding loyalty. You can do this in various ways, for instance: sending gift vouchers or giving out discounts. A good example are energy companies. They generally only give discounts to new customers. Some energy companies now choose to reward loyalty. They offer a discount in your second year. Which actually makes it advantageous to stay with an energy company!

3. By speaking to them personally. This is especially true in business relationships (B2B). By contacting your customers and asking if everything is going well, you show that your organisation is there for them. If the account manager also has lunch with the customer, the churn threat will be drastically reduced. So maintain your contacts and build lasting, personal relationships with your customers.

Learn to predict churn

But to know exactly when to start making what effort to counter churn, you need to understand the right timing for this. So basically, you need to start learning to predict churn. Also called 'churn prediction'.

By looking for the right information, you can quickly identify at-risk customers yourself. Think of a customer who has called customer service and is still waiting for an answer after four weeks. Or an organisation that has been buying three services from you for years, but this year chooses to continue with only two. This indicates that the organisation already has one foot out the door. So you need to take action at that point!

Customer feedback plays a crucial role in churn prediction

Besides analysing sales behaviour, another very crucial source of information that gives you insight into a customer's churn risk is customer feedback. By proactively soliciting feedback, you give your organisation the opportunity to get feedback from customers. Customers who are not completely satisfied and fill in a survey will indicate exactly what they think of your service. With this information, you can find out what the customer's experience is.

Combine customer feedback with your operational data (such as sales behaviour) and customer service data (such as number of contact moments, waiting times and time to resolution) and you have a complete picture of the customer's experience, both quantitatively (in numbers) and qualitatively (his or her opinion).

Six steps to be able to predict churn

I imagine this sounds logical, but a lot trickier to execute. We have therefore written down some steps that will help you towards mapping all this information.

Step 1. Get a CRM system in which you keep operational data, such as sales figures, at customer level. This way, you know what your customer purchases and when they do so.

Step 2. Invest in customer service software where you can store or log emails, phone calls and chat conversations at customer level.

Step 3. Make sure you bring this data together. You can do this by connecting systems (using an open API). Even better, of course, is if you find a party that offers all these capabilities in one. But in reality, organisations already use different systems and the main goal is to bring the data from these systems together.

Step 4. Deploy a feedback platform which can connect to your CRM system and/or customer service system and automatically send out feedback requests based on the certain triggers. For example: customer has had a phone conversation with customer service -> send the survey that asks questions about customer service. The same goes for answering questions via emails and reviewing your newsletters ("what do you. think. of. this. email"). The more different touchpoints you map, the better your picture becomes about customer experience.

At Insocial, we help organisations set up such a feedback landscape. We start small by measuring the most important touch point first. Then we expand to the next touch points. We also help you analyse this data and deliver actionable insights. Insights you can immediately use to make improvements.

Step 5. Also make customer feedback visible at customer level in your CRM system. You can achieve this by sending 'underwater' data along with your survey. Think of a 'customer ID'. This way, you know exactly which feedback belongs to which customer.

Step 6. You now have a complete picture in your CRM system of each customer. What they bought and the change in their buying behaviour, how many contact moments they had and which ones and what they thought of them. The task now is to learn from this. When exactly are your customers switching to a competitor? And thus when would you say churn risk increases?

Consider the example mentioned earlier: the customer is taking one less service this year. If that same customer is then also not too positive about his or her conversation with customer service, you know: you need to take action. Therefore, set up several automatic alerts that go off when these changes occur. For example, notify the corresponding account manager or set up a team to pick up these alerts.

Don't forget about the external factors

Even when you do everything right, your customers are extremely satisfied and engaged, you can still lose customers. This is because, in some cases, this is not due to your organisation, but to external factors. An example would be new regulations, change in household, a new legislation or even a global pandemic like the current coronavirus. Nobody saw this coming, but it has definitely had an effect on their churn rate for a lot of companies. So keep a close eye on the market, your competitors and the legislation that applies to your organisation, and take quick action on changes.

Conclusion

In short, start by calculating your churn rate and then determine what actions you need to take based on a number of insights. By investing in a CRM system, your customer service and by proactively asking for feedback, you can keep the churn rate as low as possible. After all, prevention is always better than cure! When you pay structural attention to your customer relations, you increase their loyalty, which reduces the chance of them defecting to a competitor. Still, customers will always leave you over time. This is because external factors can always play a role as well.

Understand your customers' needs directly with Insocial!

With Insocial, you will understand your customers' needs and wants in no time. Because we help you automatically retrieve feedback at every interaction moment with your customer. With these actionable insights, you know exactly what is going well, what the bottlenecks are and where you can best invest!